GST LUT Form: A Comprehensive Guide for Exporters

Indian exporters require the Letter of Undertaking form for their business purpose. This is an important instrument that allows them to engage in export activities without having to initially pay Integrated Goods and Services Tax (IGST). We discuss GST LUT its objective, eligibility, benefits, filing process, and some important exporter-related matters in this blog.

What is GST LUT?

GST LUT is a letter of Undertaking in the framework of Goods and Services Tax. It is a declaration submitted by registered exporters with a promise to comply with GST legislation and rules of export with or without IGST payment during the supply. Submission of LUT makes it possible for exporters to provide zero-rated supply, i.e., their export is GST exempted, and so they can miss the first IGST payment along with the ensuing cumbersome refund process.

Who Can Submit GST LUT?

Eligibility criteria for filing a GST LUT include:

- The applicant must be a registered GST taxpayer engaged in either goods or services export.

- Exporters should not be charged with tax evasion of Rs. 250 lakh or more.

- There must be no previous defaults or outstanding GST dues.

- Exporters must intend to supply goods or services to Special Economic Zones (SEZS) or foreign countries.

- Filing a LUT does not have any minimum turnover requirements.

- To fulfil their export obligations, exporters must be financially sound.

Benefits of Filing

Filing a Letter has several advantages that make export procedures easier and improve corporate efficiency:

Exports are exempt from IGST payments

Exporters are able to export goods or services without paying IGST in advance, thus avoiding the need to wait for refunds, which may be time-consuming and impact cash flow.

Exporters who do not need to pay taxes in advance retain more liquidity, which enables them to invest in operations, raw materials, or market expansion.

Less Paperwork

The process of filing is done online and does not require much paperwork, which makes administration easier.

Exporters who shun GST refund claim-related delays could facilitate faster payment and reinvestment.

Validity for One Financial Year

Since the Letter of Undertaking is good for the whole fiscal year, there is less need for frequent renewals and paperwork.

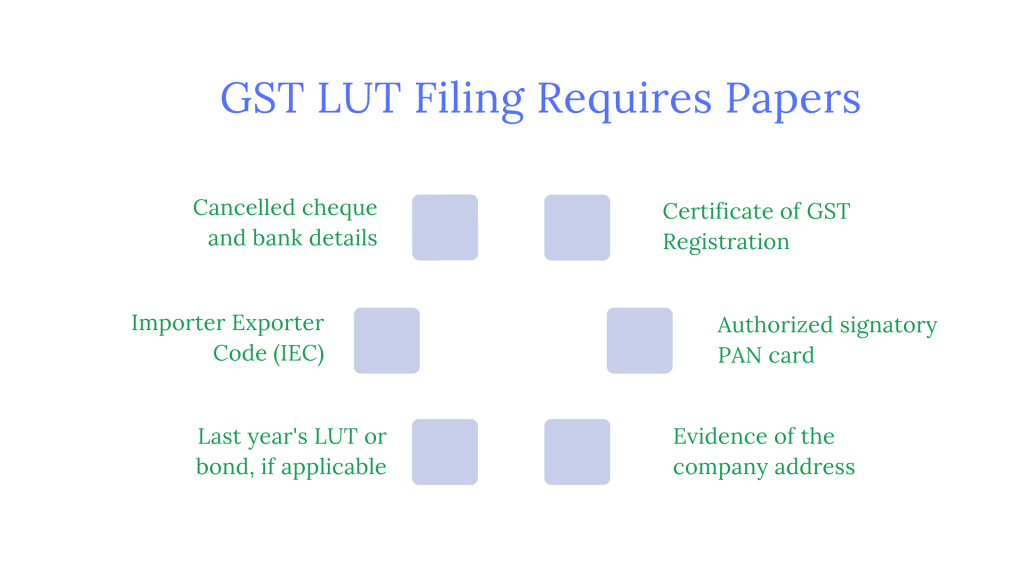

GST LUT Filing Requires Papers

Exporters seeking to file need to furnish certain documents:

- Certificate of GST Registration

- Authorized signatory PAN card

- Evidence of the company address

- Cancelled cheque and bank details

- Importer Exporter Code (IEC)

- Last year’s LUT or bond, if applicable

- Self-declaration confirming compliance with GST export conditions.

Filing GST LUT: Steps

Filing a GST LUT: It is very easy and entirely online through the GST portal:Access the GST Portal by logging

- Go to Application: Navigate to ‘Services’ > ‘User Services’ > ‘Furnish Letter of Undertaking.

- Provide information: Provide business details such as GSTIN, exporter name, and address.

- Submit the required supporting documents.

- Sign the self-declaration attesting to GST export rule compliance.

- Send the form in electronic form.

- Acknowledgement: Obtain an Application Reference Number (ARN) confirming successful submission.

Each exporter has to send a new letter at the start of each fiscal year. A bond typically on non-judicial stamp paper shall be furnished in lieu if the requirements of LUT are not met or if the exporter is ineligible.

Important Issues

- This file is valid for only one financial year

- It needs to be renewed annually

- If the exporter neglects the file requirements, the benefits can be withdrawn, and the exporter has to pay GST upfront and claim reimbursements subsequently.

- If an exporter is found guilty of serious tax evasion, they can not file further.

- The file facilitates SEZS and other countries to export.

- Proper filing and timely document maintenance prevent penalties.

- This file can be beneficial for smooth export operations.

Get Started with TaxDunia

One of the major compliance tools, the GST LUT Form, allows Indian exporters to offer services and products without payment of IGST in advance, thus enhancing cash flow, lessening administrative burden, and streamlining the export process. Eligible exporters filing Form GST RFD-11 must file the required documents and declarations annually through the GST system. Exporters can have more dynamic corporate operations under the GST regime and boost their competitiveness in international markets using the LUT. Exporters with a clear idea of the GST LUT can properly negotiate the GST export mechanism, thereby ensuring compliance and maximising operational and financial advantages.